Inflation

- Inflation is the sustained increase in the average price level.

- Low and stable inflation (around 2%) is one of the macroeconomic goals.

- Inflation is kept in check primarily through monetary and fiscal policies.

- Inflation rate is the percentage change in prices from year to year.

Disinflation

- Disinflation is when the average price level is continuing to rise but at a slower rate.

- The rate of inflation is still positive but lower than previously recorded.

- Make sure not to confuse disinflation with deflation, as during disinflation there is still an increase in the average price level.

- In an AD-AS diagram, a decrease in the price level in the short term can be considered to show disinflation.

Causes of Inflation

Cost-Push

- Inflation as a result of an increase in the costs of production in the economy, such as an increase in the price of raw materials, imports or labor.

- Price level is pushed up.

- In an AD-AS diagram, SRAS decreases and shifts to the left.

Demand-Pull

- Inflation as a result of an increase in AD (C + I + G + Xn).

- The price level is pulled up.

- In an AD-AS diagram, AD increases and shifts to the right.

Money Supply

- An increase in the money supply can also lead to inflation.

- If there is too much money in circulation, spending is increased, resulting in an increase in AD and therefore inflation.

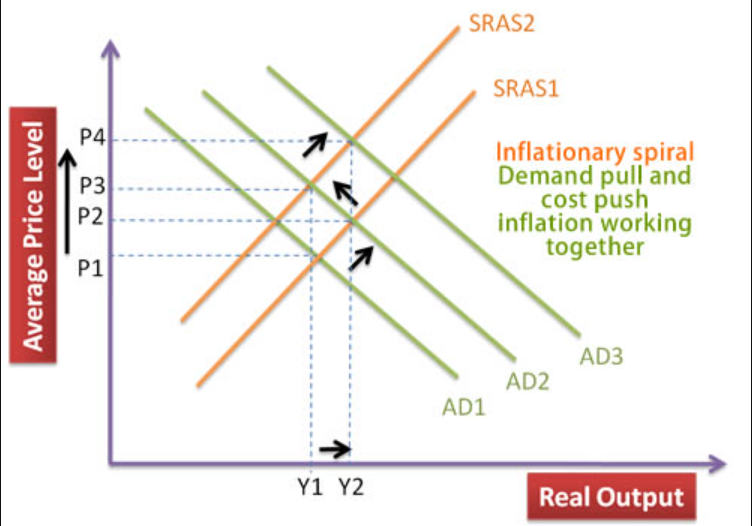

Inflationary Sprial

- Demand-pull inflation and cost-push inflation combined can cause an inflationary spiral.

- As consumers drive prices higher, businesses also pay higher prices.

- Additionally, workers demand higher wages due to the increase in the cost of living.

- These events fuel even more inflation.

- The cycle builds on itself, leading to more and more inflation.

- An inflationary spiral can lead to hyperinflation, causing super high prices.

- This makes it very difficult to export goods, leading to lay-offs.

- On an AD-AS diagram, an inflationary spiral can be seen as a continuous upwards shift in the SRAS and AD curves.

- SRAS decreases, and AD increases as a result, causing SRAS to decrease and so forth.

Costs of High Inflation Rate

Uncertainty

- Lack of confidence leads to businesses and consumers being careful, reducing their consumption and investment.

- It could possibly lead to over-consumption if consumers expect prices to be higher in the future.

- This further drives inflation.

Redistribution Effects

- Low income households are affected more than higher income households, leading to inequity.

Saving Effects

- If the inflation rate is greater than an interest rate, you are better off not saving money.

Decrease in Economic Growth

- A decrease in purchasing power and uncertainty leads suppliers and consumers to reduce economic activity.

Damage to Exports

- Inflation makes domestic goods more expensive for trading partners

Solutions to Inflation

- Inflation is a short-term problem that needs a short-term solution

- Demand side policies are more short term focused, so they would apply

- Supply side policies are generally long term and too slow to take affect

Which Demand Side Policies?

- Contractionary policies such as increasing taxes and reducing government spending are highly unpopular and might bring GDP (further) down.

- This is the reason central banks are indepedent from the government.

- The central bank does not need to be popular as they aren't elected.

- Central banks often have 1 task: keep inflation low or around 2%

- Monetary policies are seen as the best way to control inflation

Economic Goals of Low Inflation and Low Unemployment

- In the peak of a business cycle, there is low unemployment yet high inflation.

- In the trough of a business cycle, there is high unemployment and low inflation.

- It is difficult to make the two exist at the same time, as unemployment directly affects aggregate demand which affects inflation.

- When there is low unemployment, people have more spending power, leading to an increase in consumption and thus AD, leading to cost-push inflation.

- When there is low inflation, it is often due to lower AD.

Deflation

- Deflation is a sustained decrease in the average price level or a negative inflation rate.

- Deflation is avoided because people hoard money and assets due to an increase in value.

- This decreases consumer spending (GDP).

- The 2% inflation rate lets there be a buffer between inflation and deflation.

Good Deflation

- In an neoclassical AD-AS graph, if the LRAS curve shifts to the right, then there is an increase in real GDP, yet a decrease in the price level, assuming AD stays the same.

- While a mostly theoretical scenario, this would be beneficial to the economy, and is called good deflation.

- This is because it leads to economic growth, and a reduction in the aggregate price level means those with less income now have more purchasing power.

Bad Deflation

- Bad deflation occurs when aggregate demand falls.

- This means there is reduced GDP due to a recessionary gap, and thus it is called bad deflation.

Costs of Deflation

Uncertainty

- Lack of confidence leads to businesses and consumers being careful

Deferred Consumption

- Consumers defer to spend money as their money is gaining value

- This can lead to hoarding which reduces consumption, causing more deflation.

Cyclical Unemployment

- Deflation typically indicates falling economic output, meaning firms may have to lay-off workers

Increase in Real Value of Debt

- Size of real debt grows as money gains in purchasing power.

Re-distributive Effects

- Winners: fixed income earners and lenders (banks).

- The money earned from interest payments or from fixed incomes has far more purchasing power.

- Losers: borrowers and providers of fixed incomes (e.g. government).

- Borrowers have to pay higher interest and fixed income providers have to pay more for income as deflation increases the purchasing power of these fixed amounts.

- This causes inequity as certain groups benefit from deflation whereas others lose.

Policy Ineffectiveness

- Even with the use of expansionary monetary and fiscal policies, it will be difficult to convince firms and consumers to borrow money.

Sources