Definitions

- Fiscal policy is the term for when the government intervenes in the market using taxation or government spending.

- Fiscal policy is a type of demand-side policy.

Budget

- The government creates a budget yearly that outlines their revenue and how they plan to spend money.

- Budget deficit = government spending > government revenue

- Budget surplus = government spending < government revenue

- Balanced budget = government spending = government revenue

- If a government is making a budget deficit it means they have to take on debt to pay for their expenses.

- A budget surplus is desired, as it means governments can start paying back their loans, although many governments nowadays run a budget deficit.

Government Revenue Resources

Direct and Indirect Taxation

- Direct taxes such as income taxes and indirect taxes such as sales tax, provides the government with revenue.

- Social security payments by households and firms also provide revenue.

Sale of State-Owned Goods/Services

- State-owned businesses or enterprises often gain revenue such as airlines, postal services or oil companies.

Selling State-Owned Assets

- Privatization: the process of transferring ownership of a firm to the private sector from the government.

Types of Taxes

Direct Taxes

- Taxes placed directly on individuals are typically placed on income and wealth paid directly to the government.

- Direct taxes cannot be legally avoided.

- For example: income tax, corporate taxes, wealth taxes

Indirect Taxes

- Taxes placed on spending on goods and services paid indirectly to the government.

- Indirect taxes can be avoided buy cutting on consumption of goods and services with a high VAT tax or on imported goods.

- Examples: sales tax, VAT, goods and services tax (GST), tariffs

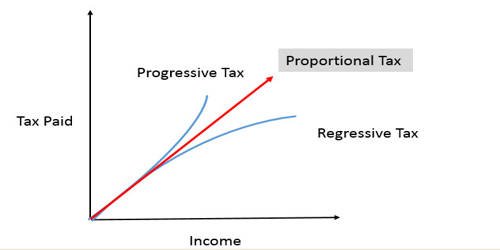

Progressive, Regressive and Proportional Taxes

- All taxes can be placed into one of three categories.

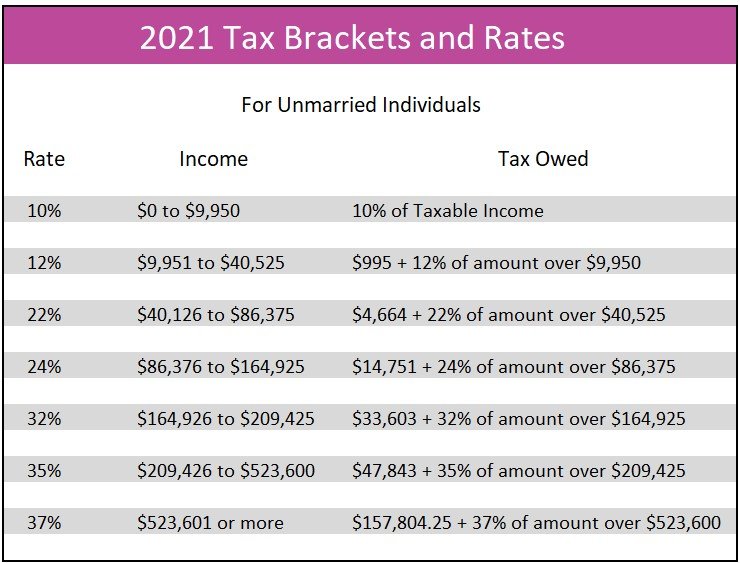

Progressive Taxes

- Taxation where the fraction/proportion of tax paid increases as income increases.

- Progressive income taxes separate people's incomes into separate tax brackets, which are each taxed at different rates.

- Average tax rate = tax/income

- This means that the average tax rate increases with increases in income.

Regressive Taxes

- Taxation where the fraction/proportion of tax paid increases as income decreases.

- All indirect taxes are regressive.

Proportional Taxes

- A system of taxation where tax is levied at a constant rate as income rises.

Government Spending

Current Expenditures

- The daily cost of keeping the government operational.

- For example salaries of workers in the public sector, armed forces.

Capital Expenditures

- The sum of all building and infrastructure financed by the government.

- For example building schools, fire stations, roads hospitals.

Transfer Payments

- A singular type of payment from the government to individuals typically to redistribute income or aid citizens.

- For example child support, pension, unemployment payments, COVID stimulus payments.

Goals of Fiscal Policy

- Similar to Monetary Policy

- Low and stable inflation rate

- Low unemployment

- Promoting a stable environment for economic growth

- Reducing business cycle fluctuations

- External balance.

Equitable Distribution of Income

- Through a progressive direct tax system and indirectly taxing luxury goods, the government can improve the distribution of income.

Expansionary Policy

- To correct a recessionary gap, governments could use expansionary fiscal policy to increase aggregate demand.

- Expansionary fiscal policy is government spending and it increases AD.

- Expansionary policy is difficult as it often requires a budget deficit which can lead to debt.

- This can make it difficult to maintain their goal of a sustainable amount of debt.

- According to the neoclassical theory, government spending is not needed as the deflationary gap will correct itself naturally.

Contractionary Policy

- To correct an inflationary gap, governments would possibly use expansionary fiscal policy to decrease aggregate demand.

- Contractionary fiscal policy is taxation and it decreases AD.

- According to neoclassical theory, taxation is not needed as the inflationary gap will correct itself.

Strengths of Fiscal Policy

- Government intervention is required for Keynesian view.

- The neoclassical view however suggests it is not necessary.

Specified Sector

- Able to target specific sectors of an economy.

Automatic

- Effective in a recession (automatic stabilizers).

Tangible Impact

- Direct impact of AD.

Limitations of Fiscal Policy

Political Pressure

- Differing political parties have different beliefs on what is best for the economy.

- These differences frequently lead to longer response times.

Time Lags

- The government takes time to notice a problem, develop a policy, and then implement that policy.

- These policies take time to be effective.

Sustainable Debt

- Governments must spend money to stimulate the economy if needed.

- These expenditures compile and may turn into large amounts of debt.

Crowding Out

- When government spending on the public sector drives down the private sector spending (consumption and investment).

Targeted

- It is hard to make it achieve specific targets.

- It is difficult to predict the precise outcome of any fiscal policy.

Debt

- Debt is the total amount of money that a government owes to its creditors, both domestic and foreign.

- For example owners of bonds and central banks from which loans are taken.

- Accumulation of budget deficit, leads to debt.

- Debt is often expressed as a percentage of GDP.

Negative Effects of Debt

Crowding out

- Interest payments are a part of government expenditure.

- More debt leads to a higher percentage of government expenditure that needs to go to interest payments.

Taxation

- Requires higher levels of taxes to fund expenditure.

Response to Emergencies

- High debt may decrease the ability of governments to respond to emergencies.

Keynesian Multiplier (HL)

- When the government spends money, there is a far larger affect on aggregate demand than just the value of the injection itself.

- This is called the Keynesian multiplier.

- For example, if a government pays a firm $100 million to build a new highway, then that firm buys raw materials pays households with wages who then spend those wages, leading to an overall increase in AD greater than $100 million.

Circular Flow and Government Spending

Marginal Propensity to Save (MPS)

- MPS is the proportion of income that households choose to save.

Marginal Rate of Taxation (MRT)

- MRT is the proportion of income that households pay in taxes.

Marginal Propensity to Consume (MPC)

- MPC is the proportion of income that households choose to spend and that affects domestic economy.

Marginal Propensity to Import (MPM)

- MPI is the proportion of income that households choose to spend on imported goods.

Examples

Building a New School Scenario

- The government contracts out this building and hires a construction company.

- This construction company must then purchase resources to build this school.

- Additionally, they hire more employees for the job.

- Households now receive more income.

- Households will either spend or save that income.

Highway Scenario

- Assume Households MPC = 30% or 0.3

- Households spend 30% of the additional income they receive 0.3*$100 million = $30 million

- Firms must now adjust their inventory due to the increase in spending.

- This requires more factors of production to be purchased.

- Households now have additional income and are now spending an additional 0.3*$30 million = $9 million.

- The chain reaction would continue until the $100 million initial government spending would result in a $142 million outcome.

- The chain continues until the change is negligibly small.

Calculating the Keynesian Multiplier

- As households will spend the money they recieve multiplied by the MPC every time they receive money, this will lead to a loop that is modelled as a geometric series.

- The sum of an infinite geometric series where the multiplier is less than 1 is written as 1/(1-multiplier).

- Thus the Keynesian multiplier is written as:

- Multiplier = 1/(1-MPC)

- Where MPC is written as a decimal number.

- There is an alternative way to measure the multiplier.

- It is defined as:

- Multiplier = 1/(MPS + MPT + MPM)

- This works because MPS, MPT and MPM are all activities that do not make the economy grow.

- Therefore:

- the proportion of income that does not make the economy grow =1-the proportion of income that does make the economy grow.

Calculating the Change in GDP

- Change in GDP = Keynesian multiplier*the change in expenditure

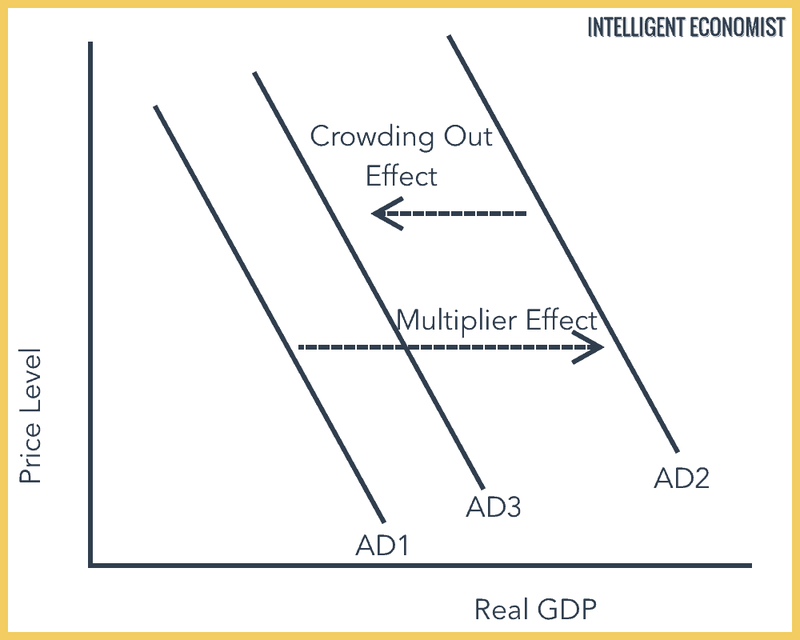

Crowding Out

- Crowding out is when government spending on the public sector drives down private sector spending.

This means an increase in government spending can reduce consumption and investment.

Example

- If the government decides to build a new school they must increase their spending.

The government must demand more money resulting in an increase to the overall interest rate. - As interest rates rise, firms will find it too expensive to invest in new projects and spending.

- This results in a decrease in consumption and investment.

- Fiscal policy should lead to a readjustment of AD to equilibrium (AD -> AD1).

- However, due to crowding out, investment and consumption fall, resulting in a decrease to AD2.

Automatic Stabilizers

- Fiscal policies has two underlying policies which are automatic stabilizers.

- These are progressive income taxes (taxation) and unemployment benefits (government spending).

- These reduce business cycle fluctuations without an government intervention and occur automatically.

- Progressive income taxes function as an automatic stabilizer, as with increases in income they will tax progressively more, discouraging increasing consumption further.

- Progressive taxes also tax progressively less when people are making less income, meaning it encourages consumption during a recession where wages are reduced.

- Unemployment benefits allow people who have no jobs to still have some income, meaning they can continue to consume.

- With these benefits, it is hoped that people will continue to consume even if they lose their job during a recession.

- Unemployment benefits only affect those who don't have jobs, meaning it doesn't boost consumption during an expansion.

Economic Recession

- Unemployment rises and the government spends more on unemployment benefits.

- For those that keep their jobs, wages fall with Average Price Level.

- Lower wages push individuals into a lower tax bracket, allowing them to save money.

- Decrease government tax revenue.

- An increase in government spending and a decrease in taxes will encourage consumption and increase aggregate demand so that the economy returns to full employment.

Economic Expansion

- Unemployment falls and the government spends less on unemployment benefits.

- As individuals are hired and receive an increase in wages, they are pushed into a higher tax bracket meaning that they pay more income tax.

- Increase government tax revenue.

- A decrease in government spending and an increase in taxes will slow down the economy to combat the inflation and return to full employment.