Definitions

Exhange Rate

- The value of one currency expressed in terms of another currency

Exchange Rate Regime/System

- The way a country manages its exchange rated.

- Fixed exchange rate

- Floating exchange rate

- Managed exchange rate

Foreign Exchange Market (FOREX)

- Marketplace for exchanging currencies around the globe.

- Done by banks and institutions.

- Currency trade is one of the most risky types of trades there is.

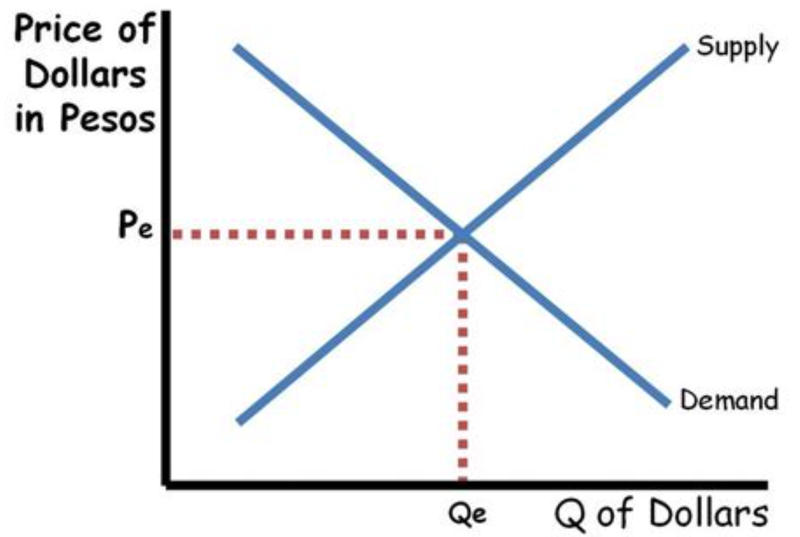

Exchange Rate Graphs

- The y-axis is one currency compared to another

- For example Euro/USD, which shows the price of 1 USD in Euros.

- The x-axis is the quantity of the second currency, which in this example would be USD.

- The graph then has a supply curve for USD and a demand curve for USD.

- The point which they meet determines the quantity of USD on the x-axis and the exchange rate on the y-axis.

Causes of Change of Demand of a Currency

- When people convert their currencies to a new currency, they demand more of the new currency, causing an increase in the quantity demanded of the currency.

- For example, the USA;

- Foreign demand of US exports

- People who desire to invest in the US (FDI and interest rates)

- Tourists visiting the US

- Positive speculation in the FOREX market

- Central bank intervention, buying dollars to increase value

- Political instability

Exhaustative List of Influences to the Demand and Supply of a Currency

- Foreign demand for exports

- Domestic demand for imports

- Inward/outward foreign direct investment (FDI)

- Inward/outward portfolio investment (bonds, shares)

- Remittances (transfer of money from abroad)

- Speculation

- Relative inflation rates

- When inflation rates lower in one country it makes their products more attractive (not as expensive)

- Relative interest rates

- Relative growth rates

- Central bank intervention

Causes of Change of Supply of a Currency

- When people convert their currencies to a new currency, they supply that old currency as they trade it in for the new one, this causes an increase in the quantity supplied of the old currency.

- When one country demands more of a currency, they must supply their own in the FOREX market.

- For example, the USA:

- Domestic demand for foreign imports

- People who desire to invest outside the US (FDI and interest rates)

- US tourists visiting Thailand

- Negative speculation in the FOREX market

- Central bank intervention, selling dollars to reduce value

Floating Exchange Rate

- An exchange rate system where the exchange rate is determined solely by the market demand and market supply of the currency in the foreign exchange market without any central bank intervention.

- This system relies solely on the invisible hand.

Appreciation and Depreciation

- In a floating exchange rate system, appreciation and depreciation can occur.

Appreciation

- When the price of a currency increases in a floating exchange rate system.

- For example, if 1USD = 0.8 Euros and later 1USD = 0.85 Euros, then the USD has appreciated.

- Appreciation can be seen in exchange rate graphs where the demand for a currency increases, or the supply for a currency decreases.

- An increase in demand causes an increase in the quantity of the currency and the exchange rate.

- A decrease in supply causes a decrease in quantity and an increase in the exchange rate.

Depreciation

- A decrease in the value of a currency in terms of another currency in a floating or managed exchange rate system.

- If at first 1USD = 0.8 Euros and later 1USD = 0.75 Euros, then the USD has depreciated.

- Depreciation can be seen in an exchange rate graph where the demand decreases or the supply of a currency increases.

- A decrease in demand leads to a decrease in quantity of the currency and a decrease in the exchange rate.

- An increase in supply leads to an increase in the quantity of the currency and a decreaaes in the exchange rate.

Fixed Exchange Rates

- One of the exchange rate regimes.

- An exchange rate system where the exchange rate is fixed, or pegged, to the value of another currency (or to the average value of a selection of currencies or some other commodity such as gold) and maintained there with appropriate central bank intervention.

- A fixed exchange rate ensures that if there would be a change in the the exchange rate, the central bank intervenes to ensure that the exchange rate is constant.

- For example, if the supply of a currency were to increase, leading to reduced ER, then the central bank would buy more of the currency to increase demand, bringing ER back to the original but leading to increased quantity of that currency.

- If a country is exporting to another country, than the currency becomes a stronger, so that the importing country no longer imports as much.

- This reduces the exchange rate between the exporter and importer, leading to a natural stabilization.

Revaluation and Devaluation

Revaluation

- Revaluation is an increase in the value of a currency in a fixed exchange rate system.

- This is when the central bank intervenes to increase ER back to the original.

Devaluation

- Devaluation is a decrease in the value of a currency in a fixed exchange rate system.

- This is when the central bank intervenes to reduce ER back to the original.

How Do Governments Intervene?

- Using their reserves of foreign currencies to buy or sell foreign currencies.

- If the a currency is weak, then the central bank can buy more of a currency to increase its exchange rate by increasing its demand.

- If a currency is too strong, then a central bank can buy more of foreign currencies to reduce the ER of the domestic currency by increasing its supply.

- By changing interest rates.

- Increased interest rate increases the demand for a currency as people want to save in that currency.

- Decreased interest rate decreases demand for that currency.

- However, this has consequences as changing interest rates is also a monetary policy used to control aggregate demand.

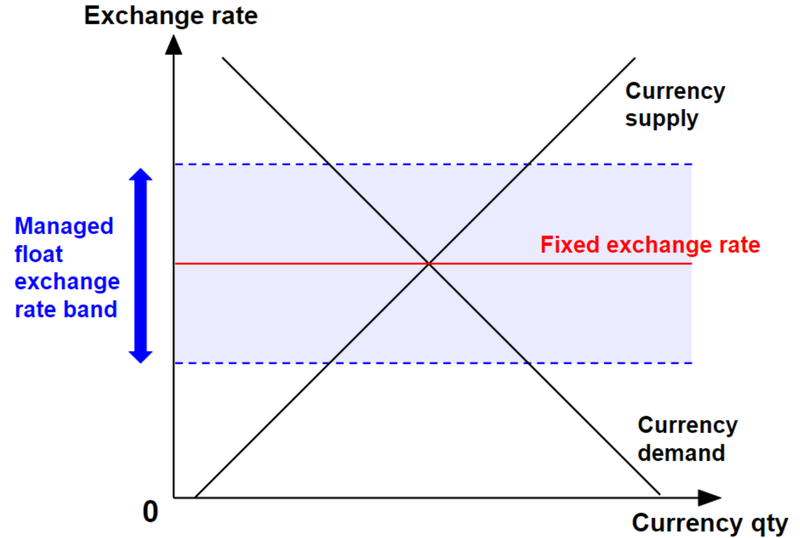

Managed Exchange Rate

- An exchange rate that floats in the foreign exchange markets but is subject to intervention from time to time by domestic monetary authorities, to prevent undesirable movements in the exchange rate.

- It is the in-between of a floating exchange rate and a fixed exchange rate.

- The central bank monitors the currency and intervenes where changes that occur are too extreme.

- Generally there is an upper and lower limit set on the possible exchange rate.

- If the exchange rate were to increase or decrease beyond the upper and lower limits respectively, then the central bank steps in.

- These limits aren't publicized to prevent speculation.

- Many countries use managed exchange rates in real life, as it is a good balance between floating and fixed exchange rate regimes.

- Only very few countries have fixed or floating exchange rate regimes.

Fixed Versus Floating Exchange Rate Regimes

Pros of Fixed Exchange Rate Regimes

- Economic stability

- Ease of policy and legislation as the exchange rate doesn't change

- In theory, the existence of a fixed exchange rate should reduce speculation in the foreign exchange markets

Cons of Fixed Exchange Rate Regimes

- Difficult and time consuming to adjust

- Might interfere with monetary policy and other policies with different goals.

- Requirement of currency reserves to reset the exchange rate.

- Setting the level of a fixed exchange rate system is complex.

- An exchange at an artificially low level may create international disagreement.

Pros of Floating Exchange Rate Regimes

- Easily adjustable (automatic)

- No need to use interest levels and that tool can be kept for monetary policy

- No requirement of currency reserves

Cons of Floating Exchange Rate Regimes

- Susceptible to speculation and large exchange rate swings (uncertainty).

- Might create even more inflation when there is a case of inflation in an economy.

- Inflation leads to less exports, which causes a weaker currency, which leads to more expensive imports, leading to further inflation.

- Complex how currency value changes and they do not necessarily self-adjust.

Sources